As a Senior Loan Officer and Mortgage Strategist with extensive experience financing homes across California, I can confidently say that most first-time buyers are not blocked by income or credit. They are blocked by cash to close. Down payments and closing costs remain the biggest obstacle, especially in higher-priced California markets.

That is exactly why the California Housing Finance Agency Dream For All program exists. When properly understood and structured, this program can significantly reduce the upfront money required to purchase a home and, in some cases, allow buyers to bring little to no money to closing.

This article breaks down how the program works, includes a real-world example, and explains how the right structure benefits buyers and realtors alike.

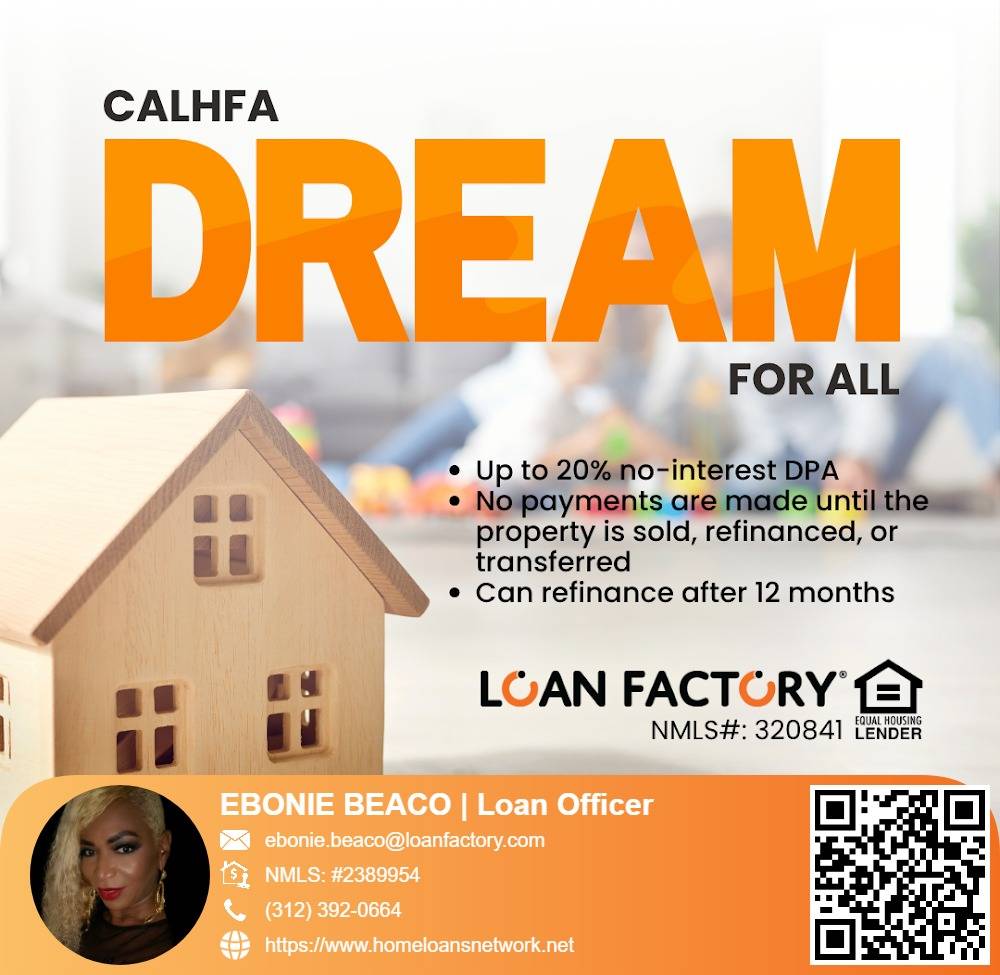

CalHFA Dream For All is a shared appreciation down payment assistance program created for first-time homebuyers in California. The program provides up to 20 percent of the home’s purchase price to be used toward the down payment and eligible closing costs.

The assistance is structured as a silent second mortgage, which means:

No monthly payments

No interest charged

Repayment is deferred

The loan is repaid only when the home is sold, refinanced, or ownership is transferred.

Unlike traditional down payment assistance loans, Dream For All does not accrue interest or require monthly repayment. Instead, the assistance is repaid through shared appreciation.

When the home is sold or refinanced:

CalHFA receives repayment of the original assistance amount

CalHFA also receives a percentage of the home’s appreciation

This structure allows buyers to enter the California housing market sooner, rather than waiting years to save a large down payment, while allowing the program to remain sustainable for future buyers.

Here is a simplified example based on real-world California transactions.

Purchase price: $600,000

Dream For All assistance: 20 percent or $120,000

That $120,000 can be applied toward:

The required down payment

Eligible closing costs

Instead of saving a traditional down payment out of pocket, the buyer uses Dream For All assistance to cover it, dramatically reducing the upfront cash needed to purchase the home.

Closing costs typically include lender fees, escrow, title, prepaid property taxes, homeowners insurance, and other transaction-related expenses. In California, these costs can easily total thousands of dollars.

When the transaction is structured correctly, buyers may be able to:

Allocate part of the Dream For All assistance toward eligible closing costs

Negotiate seller credits within the purchase contract

Combine both strategies to minimize out-of-pocket expenses

Example:

If total closing costs are $12,000 and the purchase contract includes seller credits to cover a portion of those costs, the remaining amount may be covered by Dream For All assistance. In some scenarios, this results in the buyer bringing very little or even no money to closing.

This outcome is not accidental. It comes from understanding program guidelines and structuring the loan and contract properly from the beginning.

Homeowners may refinance their first mortgage after 12 months, as long as the Dream For All assistance is repaid at the time of refinance. This gives buyers flexibility if interest rates change or their financial position improves.

Understanding this rule upfront is critical when planning long-term homeownership and equity strategy in California.

From my experience, Dream For All works best for buyers who:

Are first-time homebuyers in California

Can comfortably afford the monthly mortgage payment

Lack large savings for a down payment and closing costs

Understand and accept shared appreciation

This program can be especially impactful in higher-priced markets where saving for a down payment alone can delay homeownership for many years.

Dream For All is not simply about qualifying for assistance. The structure of the transaction determines how effective the program truly is.

Proper structure may include:

Correct allocation of assistance between down payment and closing costs

Seller credit negotiation within program guidelines

Selecting loan terms that support long-term affordability

Education is equally important. Buyers who understand shared appreciation, repayment triggers, and refinance requirements make stronger decisions and avoid surprises later.

Realtors who understand the Dream For All program gain a real advantage in today’s California market.

When agents work with a loan officer who understands CalHFA guidelines and how to structure these transactions correctly, they are able to:

Write stronger, cleaner offers

Expand the pool of qualified first-time buyers

Address seller concerns about down payment assistance upfront

Reduce last-minute financing issues that delay or derail closings

From a lending perspective, the smoothest Dream For All transactions happen when the realtor and loan officer are aligned early, before the offer is written.

CalHFA Dream For All has become one of the most impactful tools for expanding first-time homeownership in California. With up to 20 percent down payment assistance, no monthly payments, and the ability to significantly reduce closing costs, the program allows many buyers to purchase far sooner than they expected.

The key is understanding how the program works and structuring the transaction correctly from day one. When education, structure, and the right lending strategy come together, Dream For All can be a powerful pathway into California homeownership.

Ebonie Beaco

Senior Loan Officer | Mortgage Strategist

NMLS #2389954

Home Loans Network is powered by Loan Factory, Inc.

Loan Factory, Inc. NMLS #320841

Equal Housing Lender

Home Loans Network is a marketing and mortgage education platform operated independently and is Powered by Loan Factory, Inc. (NMLS #320841). Home Loans Network does not make mortgage loan commitments or fund loans. All mortgage products, approvals, rates, and terms are issued, underwritten, and finalized through Loan Factory, Inc., and/or their licensed lending partners.

Information provided on this website is for educational and informational purposes only and should not be interpreted as legal, financial, or mortgage advice. Mortgage guidelines, interest rates, program availability, and eligibility requirements are subject to change at any time without notice.

Submitting an inquiry, completing a form, or requesting information on this website does not constitute a loan application, pre-qualification, or pre-approval. You are only considered a loan applicant once you complete a formal mortgage application through Morty, Loan Factory, Inc., or one of their licensed lending partners, and all required verification, credit review, underwriting, and approval processes are completed.

Home Loans Network and its representatives strive for accuracy but make no guarantees regarding the completeness or reliability of the information provided. Borrowers should verify all details directly with Loan Factory, Inc., or a licensed mortgage professional before making financial decisions.

By using this website, you acknowledge and agree that Home Loans Network is not a lender, does not provide binding loan offers, and is not responsible for final lending decisions. All loans are subject to credit approval, property eligibility, program guidelines, and applicable federal and state regulations.