Homeownership in Florida has become increasingly competitive, especially for the very people who keep our communities running every day. Teachers, nurses, first responders, law enforcement officers, firefighters, military service members, and healthcare professionals often find themselves priced out of the market despite stable incomes and strong employment histories.

The Florida Hometown Heroes Housing Program was created to change that.

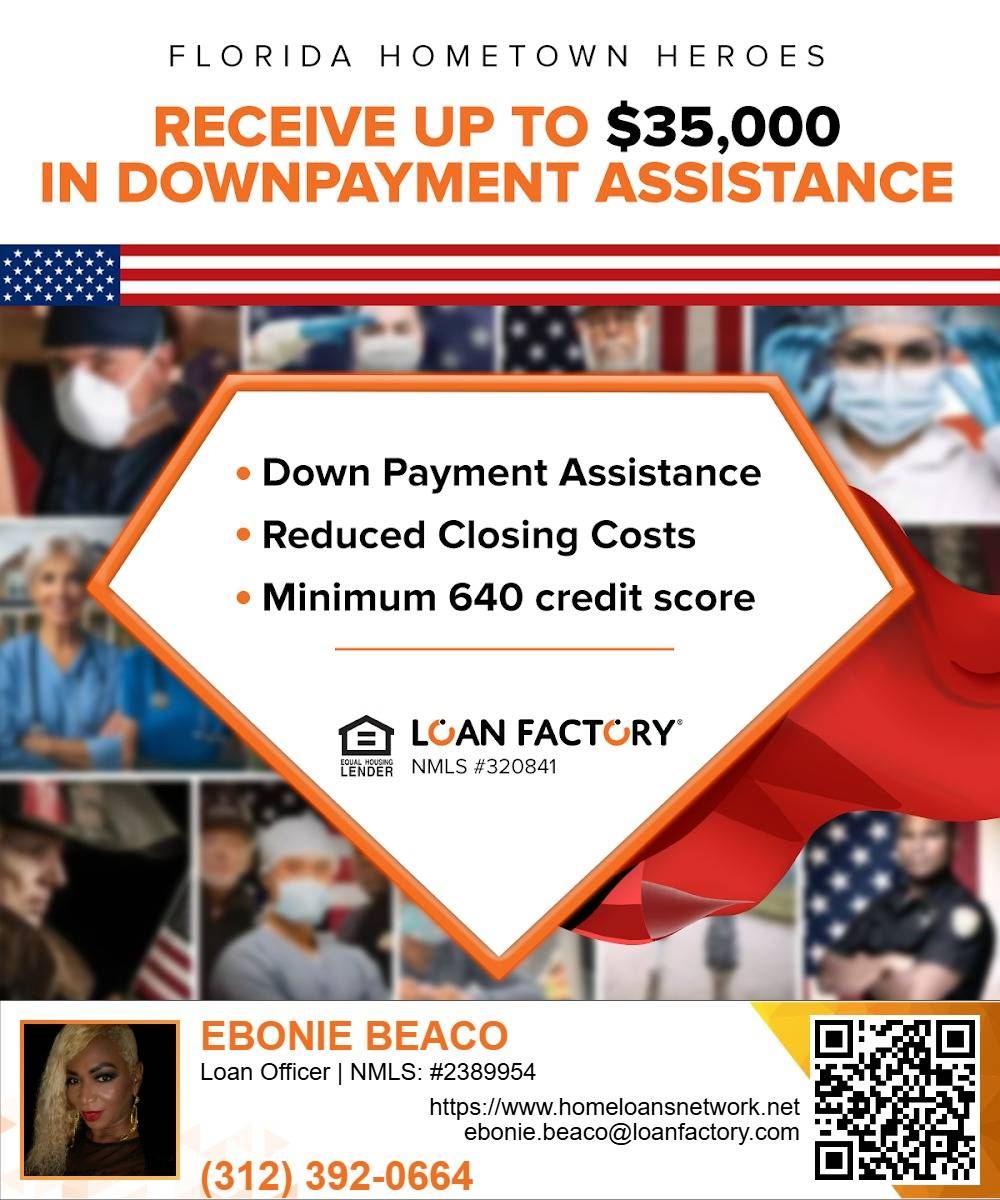

This program provides up to $35,000 in down payment and closing cost assistance to eligible frontline workers across the state of Florida, making homeownership more accessible, affordable, and sustainable.

This article serves as a complete, detailed guide to the Florida Hometown Heroes Program—who it’s for, how it works, eligibility requirements, benefits, limitations, and how to apply successfully.

The Florida Hometown Heroes Program is a state-funded housing initiative designed to assist eligible frontline workers with the upfront costs of buying a home. The goal is simple: help essential workers live in the communities they serve.

Rather than functioning as a grant that disappears, the assistance is typically structured as a deferred, forgivable second mortgage that helps cover down payment and closing costs. This significantly reduces the cash buyers need at closing—often the biggest obstacle to homeownership.

Key highlights include:

Up to $35,000 in assistance

Designed for primary residences only

Available statewide in Florida

Must be paired with an approved first mortgage

Funds are limited and subject to availability

Eligibility is based on employment, not job title alone. The program is aimed at individuals who work full-time for Florida-based employers and provide critical services to the community.

Common eligible professions include:

Teachers and school employees

Nurses and healthcare professionals

First responders

Law enforcement officers

Firefighters and EMTs

Military service members and veterans

Corrections officers

Childcare and early education professionals

Social service workers

Certain government and municipal employees

Employment must generally be full-time and based in Florida, though exact definitions can vary by lender and funding round.

Qualified buyers may receive up to $35,000 in down payment and closing cost assistance. The exact amount depends on:

Purchase price

Loan program used

County and regional limits

Available program funding

Lender guidelines

The assistance is typically provided as:

A 0% interest second mortgage

Deferred payments (no monthly payment required)

Repayment due upon sale, refinance, or payoff of the first mortgage

In some cases, portions of the assistance may be forgiven over time, depending on program terms at the time of funding.

One of the most attractive features of the Florida Hometown Heroes Program is its flexible credit standards.

Most borrowers can qualify with:

Minimum 640 credit score

Higher scores may unlock better interest rates or additional loan options, but the program was intentionally designed to remain accessible to working professionals who may not have perfect credit.

The program does impose income limits, which are based on:

County location

Household size

Area Median Income (AMI)

Unlike many traditional down payment assistance programs, Hometown Heroes income limits are often higher, allowing middle-income professionals to qualify.

Because income limits vary by county and change periodically, it’s critical to review them with a licensed loan officer before starting the home search.

To qualify under the Florida Hometown Heroes Program, the property must meet specific criteria:

Eligible properties typically include:

Single-family homes

Condos (must meet approval guidelines)

Townhomes

Manufactured homes (with restrictions)

The home must be:

Located in Florida

Owner-occupied

Used as a primary residence

Within purchase price limits

Investment properties and second homes are not allowed.

The Florida Hometown Heroes assistance is not a standalone loan. It must be paired with an approved first mortgage.

Common first mortgage options include:

Conventional loans

FHA loans

VA loans (for eligible veterans)

USDA loans (where applicable)

Your loan officer will help determine which first mortgage works best based on:

Credit profile

Income structure

Down payment needs

Property type

The program significantly reduces upfront costs, making homeownership possible sooner rather than later.

Rates are often competitive with or better than standard market rates.

A 640 minimum credit score opens the door for many buyers who thought they needed years to prepare.

This program recognizes stable employment over perfection.

Eligible buyers can purchase in urban, suburban, or rural areas throughout Florida.

“It’s only for first-time buyers.”

Not true. While many participants are first-time buyers, repeat buyers may qualify if they meet program guidelines.

“It’s free money.”

The assistance is typically structured as a second mortgage, not a grant. However, it requires no monthly payment.

“Funds are always available.”

Funding is limited and can run out quickly. Timing matters.

“I can apply on my own.”

You must work with a participating lender to access the program.

Because Hometown Heroes funds are limited, pre-approval is critical. A proper pre-approval ensures:

You meet income and employment requirements

Your credit score qualifies

You understand your true purchasing power

Funds can be reserved when available

Pre-approval also strengthens your position when making offers in competitive markets.

Speak with a licensed loan officer familiar with the program

Complete a mortgage application

Submit income, employment, and asset documentation

Receive pre-approval

Work with a real estate agent to find an eligible home

Lock in assistance when funds are available

Close on your new home

Not all lenders understand the nuances of the Florida Hometown Heroes Program. A knowledgeable loan officer will:

Monitor funding availability

Structure the loan correctly

Ensure compliance with state guidelines

Prevent delays or last-minute surprises

Maximize your assistance benefits

This program requires precision, timing, and experience.

If you:

Work full-time in Florida

Serve your community in a frontline or essential role

Have at least a 640 credit score

Want to reduce your out-of-pocket costs

Plan to live in the home you purchase

Then this program may be an excellent fit.

The Florida Hometown Heroes Program is more than a housing initiative—it’s a recognition of service, stability, and contribution to Florida communities. For many buyers, it bridges the gap between renting and owning without waiting years to save for a down payment.

Because funding is limited and guidelines evolve, the best next step is to speak directly with a licensed loan professional who can review your specific scenario.

Ebonie Beaco

Senior Loan Officer | NMLS #2389954

Powered by Loan Factory, Inc. | NMLS #320841

📞 312-392-0664

🌐 www.HomeLoansNetwork.com

Equal Housing Lender. Program availability, terms, and eligibility are subject to change.

Home Loans Network is a marketing and mortgage education platform operated independently and is Powered by Loan Factory, Inc. (NMLS #320841). Home Loans Network does not make mortgage loan commitments or fund loans. All mortgage products, approvals, rates, and terms are issued, underwritten, and finalized through Loan Factory, Inc., and/or their licensed lending partners.

Information provided on this website is for educational and informational purposes only and should not be interpreted as legal, financial, or mortgage advice. Mortgage guidelines, interest rates, program availability, and eligibility requirements are subject to change at any time without notice.

Submitting an inquiry, completing a form, or requesting information on this website does not constitute a loan application, pre-qualification, or pre-approval. You are only considered a loan applicant once you complete a formal mortgage application through Morty, Loan Factory, Inc., or one of their licensed lending partners, and all required verification, credit review, underwriting, and approval processes are completed.

Home Loans Network and its representatives strive for accuracy but make no guarantees regarding the completeness or reliability of the information provided. Borrowers should verify all details directly with Loan Factory, Inc., or a licensed mortgage professional before making financial decisions.

By using this website, you acknowledge and agree that Home Loans Network is not a lender, does not provide binding loan offers, and is not responsible for final lending decisions. All loans are subject to credit approval, property eligibility, program guidelines, and applicable federal and state regulations.