Buying a home in 2026 doesn’t have to feel impossible — even with rising prices, tight inventory, and increasing competition. One of the biggest obstacles for first-time buyers is the down payment, but today’s Down Payment Assistance (DPA) programs can dramatically reduce how much cash you need upfront.

Whether you're purchasing your first home or transitioning from renting to ownership, these programs can help you build wealth sooner, avoid years of saving, and enter the market with confidence.

Below are the Top 10 Down Payment Assistance Programs every first-time buyer should know this year — broken down into federal, state/local, employer, and profession-based options.

The FHA loan remains one of the most common tools for first-time buyers. While FHA itself does not provide grants, it allows buyers to combine the minimum 3.5% down payment requirement with outside assistance.

Many nonprofits offer forgivable second mortgages or grants designed to work with FHA loans, allowing buyers to come in with minimal cash.

Members of the Federal Home Loan Bank system offer programs that help low- to moderate-income buyers. Many include matching funds toward the buyer’s down payment — sometimes up to 4:1.

These programs are flexible and ideal for first-time buyers needing extra support.

While the federal government doesn’t provide a single national down payment grant, it does offer access to HUD-approved local agencies, homebuyer counseling programs, and state housing finance authorities.

These resources help buyers identify grants and low-interest second mortgages available in their area.

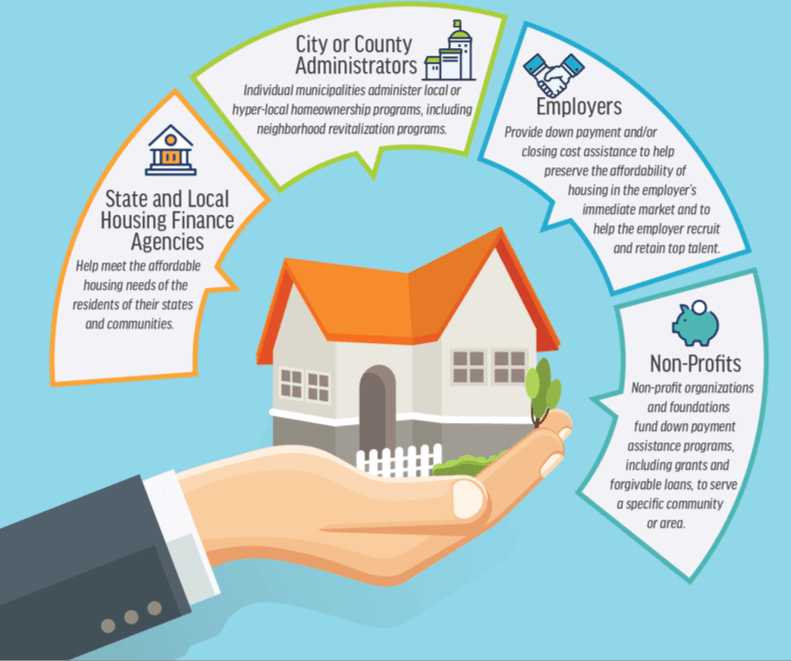

State and local housing agencies often offer some of the most substantial DPA options in the country. These include grants, deferred loans, and forgivable second mortgages.

Most states offer DPA programs targeting first-time buyers or those purchasing in specific “targeted areas.”

Programs may include grants, 0% interest second mortgages, or forgivable loans, usually paired with FHA, VA, USDA, or conventional loans.

Major cities across the U.S. offer large DPA programs, sometimes between $10,000 and $100,000.

Buyers are often required to complete a homeownership course and live in the home for a set number of years.

Many states offer 0% interest second mortgages with no monthly payments.

These loans can be forgiven after a set period — typically five to ten years — as long as the buyer remains in the home.

As housing affordability challenges grow, more employers and industries are offering assistance programs to help employees become homeowners.

Increasingly, hospitals, universities, and corporations offer homebuyer assistance benefits.

These perks may include grants, matching contributions, or forgivable loans for employees purchasing near their workplace.

Nurses, medical assistants, and healthcare workers may qualify for special down payment assistance, grants, and reduced closing costs.

These programs help essential workers secure stable housing near their workplaces.

Teachers, school employees, and education professionals can access special grants and DPA options.

These programs are designed to help educators live in the communities they serve.

Police officers, firefighters, EMTs, and government employees may qualify for grants, forgivable loans, and even 100% financing options.

These programs support community stability and reward essential public servants.

Choosing the right DPA program requires understanding:

Income eligibility

Credit score requirements

First-time homebuyer status

Your profession or employment

Loan type (FHA, Conventional, VA, USDA)

Primary residence requirements

Forgiveness or repayment rules

Some programs can be stacked together, allowing buyers to combine federal, state, and profession-based DPA for maximum savings.

Down Payment Assistance is one of the biggest game changers in 2025’s housing market.

Whether through federal backing, state grants, or profession-based benefits, these programs exist to make homeownership possible now — not years from now.

For qualified buyers, it’s often possible to purchase a home with little to no money down, freeing up cash for moving, renovations, or financial savings.

If you’re a first-time buyer in 2025, you don’t have to wait years to save for a large down payment. With the right strategy — and the right mortgage professional — you can take advantage of powerful Down Payment Assistance programs that dramatically reduce your upfront costs and help you become a homeowner sooner than you think.

As a Mortgage Loan Officer and real estate expert with 25+ years of hands-on experience helping buyers break through barriers and build long-term wealth through homeownership, I’ll walk you through every available program you qualify for — federal, state, local, employer-based, and profession-specific. My goal is simple: to help you purchase your home with confidence, clarity, and the lowest cash out of pocket.

I’ll review your income, credit, and goals, then map out the Down Payment Assistance programs you can use right now — including grants, forgivable loans, and special incentives for first-time buyers, essential workers, and buyers in specific communities.

👉Explore more mortgage resources here:

Let’s turn your dream of homeownership into a reality.

Empowering Homeowners. Financing Investors.

Home Loans Network is a marketing and mortgage education platform operated independently and is Powered by Loan Factory, Inc. (NMLS #320841). Home Loans Network does not make mortgage loan commitments or fund loans. All mortgage products, approvals, rates, and terms are issued, underwritten, and finalized through Loan Factory, Inc., and/or their licensed lending partners.

Information provided on this website is for educational and informational purposes only and should not be interpreted as legal, financial, or mortgage advice. Mortgage guidelines, interest rates, program availability, and eligibility requirements are subject to change at any time without notice.

Submitting an inquiry, completing a form, or requesting information on this website does not constitute a loan application, pre-qualification, or pre-approval. You are only considered a loan applicant once you complete a formal mortgage application through Morty, Loan Factory, Inc., or one of their licensed lending partners, and all required verification, credit review, underwriting, and approval processes are completed.

Home Loans Network and its representatives strive for accuracy but make no guarantees regarding the completeness or reliability of the information provided. Borrowers should verify all details directly with Loan Factory, Inc., or a licensed mortgage professional before making financial decisions.

By using this website, you acknowledge and agree that Home Loans Network is not a lender, does not provide binding loan offers, and is not responsible for final lending decisions. All loans are subject to credit approval, property eligibility, program guidelines, and applicable federal and state regulations.