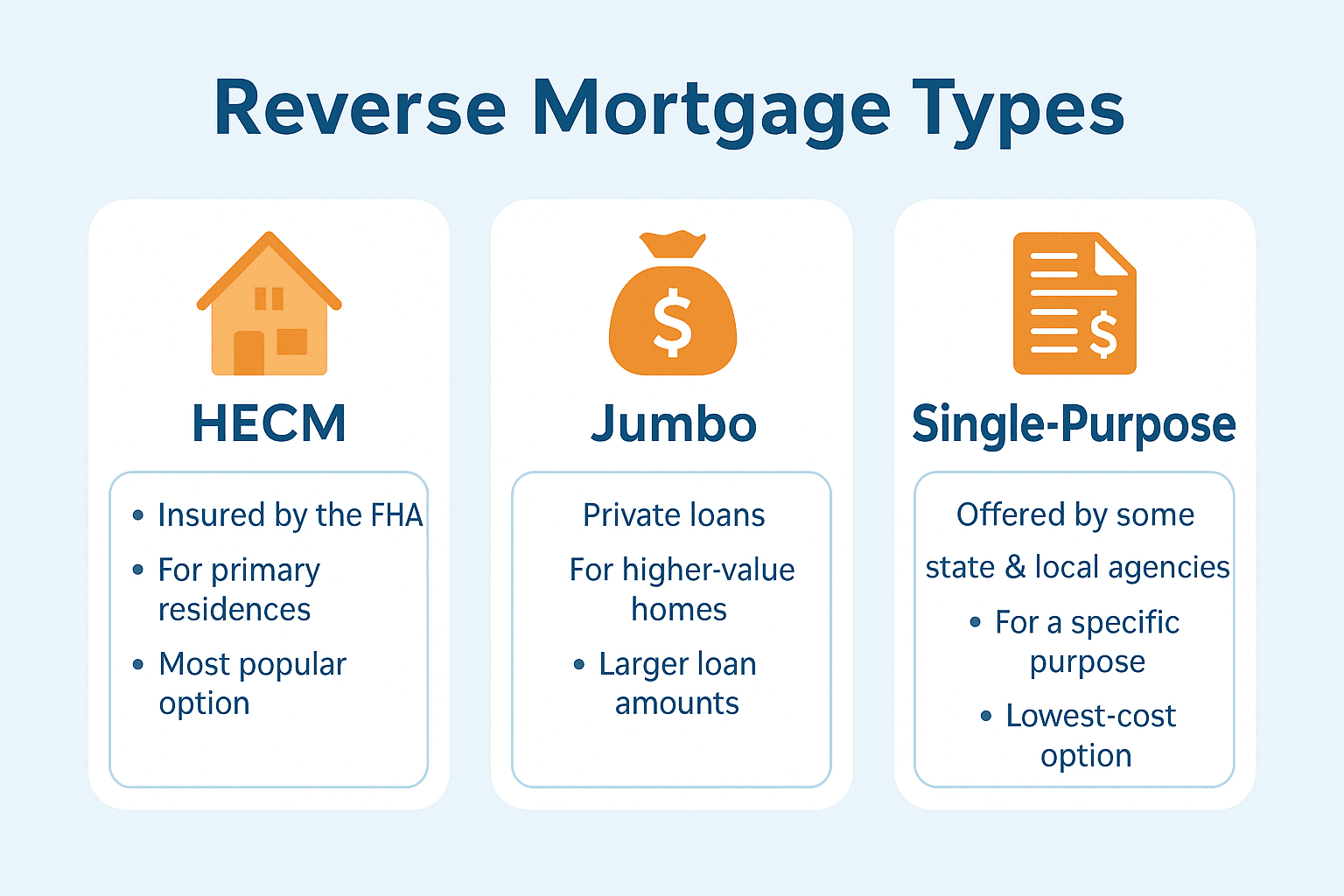

As seniors in Chicago and throughout Illinois begin exploring reverse mortgages, one of the first questions they ask me is what types of reverse mortgages exist and which one is right for them. Many homeowners are surprised to learn that there are actually three different types of reverse mortgages, each designed for specific needs and situations. Understanding these options is essential for choosing a loan that supports your retirement, protects your home, and strengthens your long term financial stability.

As a Reverse Mortgage Specialist who works with seniors in Hyde Park, Bronzeville, Jefferson Park, Beverly, South Shore, Oak Lawn, and throughout Illinois, I have guided countless homeowners through the differences between these reverse mortgage types. Some seniors want long term financial security, some need immediate access to funds, and others are navigating the transition to assisted living or inheritance planning. My responsibility is to help you understand every option clearly so you can choose the one that aligns with your goals.

This guide explains the three types of reverse mortgages in detail, the benefits they offer, the properties they apply to, and real examples from families I have helped across Illinois.

The most common and widely used reverse mortgage is the Home Equity Conversion Mortgage also known as the HECM. This is the only reverse mortgage insured by the Federal Housing Administration. It is designed for seniors age sixty two or older who want long term financial security and flexibility.

The HECM is by far the safest and most regulated reverse mortgage option. It includes protections such as no loss of homeownership, the non recourse guarantee that ensures you never owe more than the home is worth, and payout options such as monthly payments, lump sums, or a line of credit that grows over time. Most of the seniors I work with choose this option because it provides stability, customizable income, and strong protections for heirs.

A homeowner in Hyde Park used a HECM to eliminate her mortgage payment and gain a growing line of credit that she now uses for home repairs and rising property taxes. A Jefferson Park couple used a HECM to supplement their retirement income with monthly payments while keeping full ownership of their home.

HECMs are ideal for seniors who want to stay in their homes long term and create a dependable financial foundation.

A single purpose reverse mortgage is offered by certain state agencies and nonprofit organizations. It is not FHA insured and is only available for specific uses such as paying property taxes or covering necessary home repairs. These programs are less common and often have strict income and need based qualifications. The loan amount is usually smaller and the terms are more limited.

These are attractive for some seniors because they often have lower costs, but they are not available everywhere in Illinois. In many cases, homeowners come to me after discovering that their city or county does not offer this type of program. For seniors who qualify, it can be a helpful tool for preventing tax delinquency or funding essential maintenance.

One senior South Shore homeowner contacted me after learning that the local program she was hoping to use had been discontinued. We reviewed her eligibility for a HECM instead, which gave her far more flexibility, eliminated her mortgage payment, and provided additional funds for home safety improvements.

Single purpose reverse mortgages can be valuable but they are not widely available and do not offer the same long term features as a HECM.

A proprietary reverse mortgage is a privately funded loan designed for seniors with high value homes that exceed the FHA lending limits. These are commonly known as jumbo reverse mortgages. They are not insured by the FHA but are offered by private lenders who create their own guidelines.

These are ideal for homeowners with substantial equity and higher valued homes such as large properties in the West Loop, luxury condos in Streeterville, lakefront homes in Evanston or Highland Park, or custom homes throughout suburban Illinois. Many jumbo reverse mortgages allow higher loan amounts than HECMs and may offer more flexible payout structures.

I recently worked with a homeowner in an upscale Oak Brook neighborhood whose home value exceeded the FHA limit. A proprietary reverse mortgage offered her access to significantly more equity than a traditional HECM could provide. She used it to supplement her retirement income and help her grandchildren with education expenses.

Proprietary reverse mortgages are the right choice for seniors with high value homes who want greater access to the equity they have built.

The right option depends on your goals, your home value, your financial situation, and your long term plans. Every reverse mortgage works differently, which is why personalized guidance matters. Many seniors do not just choose based on loan type. They choose based on what supports their lifestyle, their health needs, and their desire to age in place.

I approach every case with clarity and care. Your home, your equity, and your retirement goals deserve tailored solutions, not one size fits all recommendations.

Reverse mortgages offer many advantages for older homeowners who want to create a more stable and stress free retirement.

✔ Eliminates monthly mortgage payments

✔ Allows seniors to stay in their home long term

✔ Provides tax free access to home equity

✔ Offers flexible payout options such as monthly income, lump sums, or lines of credit

✔ Ensures seniors never owe more than the home’s value

✔ Protects heirs through the non recourse guarantee

✔ Helps cover rising property taxes, insurance, and maintenance

✔ Supports aging in place safely and comfortably

✔ Strengthens long term financial security

Many seniors I work with tell me they finally feel in control again after choosing a reverse mortgage.

Reverse mortgages can be used on many types of primary residences throughout Illinois including single family homes, two unit homes, three unit homes, four unit homes, FHA approved condominiums, townhomes, planned unit developments, and manufactured homes that meet HUD guidelines.

I have helped seniors in condo buildings in Bronzeville, vintage two flats in South Shore, bungalows in Jefferson Park, ranch homes in Beverly, loft style condos in the West Loop, and suburban properties in Oak Lawn and Naperville. Reverse mortgages provide flexibility for homeowners across Chicago and throughout the entire state.

I have helped seniors throughout Chicago neighborhoods and across Illinois including rural towns and suburban communities. Every reverse mortgage is different because every homeowner has their own story and their own goals. I take the time to explain options clearly, compare lenders, review payout strategies, and determine whether a HECM, a proprietary reverse mortgage, or a single purpose mortgage is the best fit.

My goal is simple. To provide seniors with clarity, protection, and confidence as they navigate one of the most important financial decisions they will ever make.

Understanding the three types of reverse mortgages gives you the power to choose a loan that supports your future, not complicates it. Your home is your foundation. Your equity is a resource that can improve your retirement, reduce financial stress, and protect your long term comfort.

You deserve honest information and guidance from someone who understands this market, these regulations, and the unique needs of older homeowners.

If you want to understand which type of reverse mortgage is right for you and how much you may be eligible to receive, complete the form on the right side of this page. I will prepare a personalized and confidential reverse mortgage analysis that explains your options, your benefits, your protections, and your long term financial choices so you can make the best decision for yourself and your family.

Home Loans Network is a marketing and mortgage education platform operated independently and is Powered by Loan Factory, Inc. (NMLS #320841). Home Loans Network does not make mortgage loan commitments or fund loans. All mortgage products, approvals, rates, and terms are issued, underwritten, and finalized through Loan Factory, Inc., and/or their licensed lending partners.

Information provided on this website is for educational and informational purposes only and should not be interpreted as legal, financial, or mortgage advice. Mortgage guidelines, interest rates, program availability, and eligibility requirements are subject to change at any time without notice.

Submitting an inquiry, completing a form, or requesting information on this website does not constitute a loan application, pre-qualification, or pre-approval. You are only considered a loan applicant once you complete a formal mortgage application through Morty, Loan Factory, Inc., or one of their licensed lending partners, and all required verification, credit review, underwriting, and approval processes are completed.

Home Loans Network and its representatives strive for accuracy but make no guarantees regarding the completeness or reliability of the information provided. Borrowers should verify all details directly with Loan Factory, Inc., or a licensed mortgage professional before making financial decisions.

By using this website, you acknowledge and agree that Home Loans Network is not a lender, does not provide binding loan offers, and is not responsible for final lending decisions. All loans are subject to credit approval, property eligibility, program guidelines, and applicable federal and state regulations.